We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows.

Tvalue present value of future cashflows free#

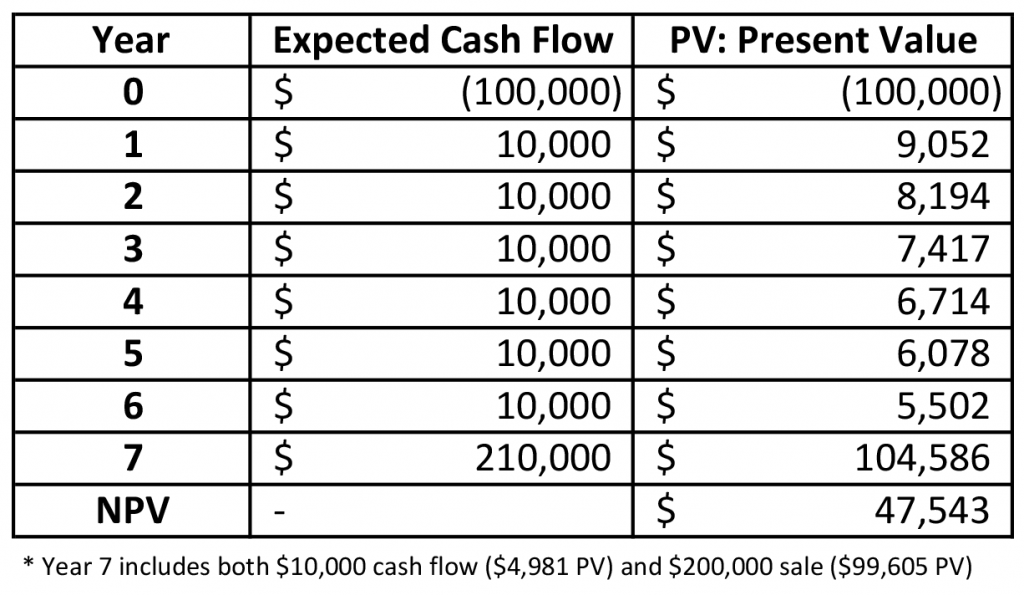

We do this to reflect that growth tends to slow more in the early years than it does in later years.Ī DCF is all about the idea that a dollar in the future is less valuable than a dollar today, and so the sum of these future cash flows is then discounted to today's value: 10-year free cash flow (FCF) estimate We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. To begin with, we have to get estimates of the next ten years of cash flows.

Generally the first stage is higher growth, and the second stage is a lower growth phase. We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. View our latest analysis for Exxon Mobil The Calculation For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you. We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. It may sound complicated, but actually it is quite simple! Our analysis will employ the Discounted Cash Flow (DCF) model. Our fair value estimate is 9.0% higher than Exxon Mobil's analyst price target of US$126ĭoes the April share price for Exxon Mobil Corporation ( NYSE:XOM) reflect what it's really worth? Today, we will estimate the stock's intrinsic value by projecting its future cash flows and then discounting them to today's value. Using the 2 Stage Free Cash Flow to Equity, Exxon Mobil fair value estimate is US$137Įxxon Mobil's US$118 share price indicates it is trading at similar levels as its fair value estimate

0 kommentar(er)

0 kommentar(er)